You pay your mortgage every month. You pay your property taxes.

So, you assume you own your home "free and clear."

But in real estate, "Ownership" isn't a feeling. It’s a piece of paper. And sometimes, that paper has a stain on it.

We call this a "Clouded Title."

It happens more often than you think. According to the American Land Title Association (ALTA), title defects are discovered in up to 36% of all real estate transactions.

That means 1 in 3 sellers has a problem they didn't know about until the week of closing.

Maybe it’s a $5,000 contractor’s lien from a roof repair in 2018. Maybe it’s a "Lis Pendens" (lawsuit notice) from the previous owner’s divorce. Or maybe it’s just a typo in the deed from 1995.

If a buyer finds this before you do, the deal dies instantly.

If you find it first, you can fix it.

Here is how to perform a DIY Title Search and scrub your property record clean before you list.

Step 1: Visit the County Recorder (The "Deed" Detective)

Just like we discussed in our guide on How Old Is My House?, the County Recorder’s office is your best friend.

You are looking for the Grantor/Grantee Index.

Grantor: The Seller (You)

Grantee: The Buyer

How to DIY it:

Go to your county’s online public records portal (search: [County Name] Recorder of Deeds).

Search for your name.

Search for the previous owner's name.

You are looking for any document labeled "Lien," "Judgment," or "Lis Pendens" that does not have a matching "Release" or "Satisfaction" document filed after it.

The Scary Example:

You might see a "Mechanic’s Lien" filed by a plumber for $2,000 in 2019. You paid him! But he forgot to file the "Release of Lien."

To a bank, that debt is still active. You cannot sell the house until he signs that paper.

Step 2: The "Municipal Lien" Search (The Hidden Debt)

This is where most DIY sellers fail.

The County Recorder only tracks debts tied to people (mortgages, lawsuits). They often miss debts tied to the property itself.

These are called Unrecorded Municipal Liens, and they are silent killers.

Code Violations: Did you forget to mow the lawn in 2021 and get a $50 fine? That fine is now a lien.

Permit Fees: Remember the "Ghost Room" we talked about in Selling a House with Unpermitted Work? If you opened a permit but never closed it, fees have been racking up for years.

Utility Bills: In some states, unpaid water or sewer bills stay with the house, not the human.

How to check:

You have to call the city (not the county). Ask for the Code Enforcement and Finance departments. Ask them specifically: "Are there any open violations or unrecorded liens on [Your Address]?"

Step 3: Check for "Encroachments" (The Physical Lien)

A lien isn't always financial. Sometimes, it’s physical.

If your fence is 6 inches onto your neighbor’s land, or if their garage overhangs your property line, you have an Encumbrance.

As we covered in Where Does My Land End?, a buyer’s surveyor will find this. If they do, the bank may refuse to fund the loan until the fence is moved.

The Fix:

Walk your property lines now. If you see an issue, sign an "Encroachment Agreement" with your neighbor before you list. This legal document says, "Yes, the fence is wrong, but we are cool with it," and it stops the bank from panicking.

What to Do If You Find a "Ghost" Lien?

So, you did your search and found a lien from 2010 that you know you paid.

Don't panic. You don't always have to pay it again.

1. The "Statute of Limitations" Strategy

In many states, Mechanic’s Liens expire after 1 year if the contractor doesn't sue you. Judgment liens often expire after 10 years.

If the lien is "expired," you just need to file a formal request to have it purged.

2. The "Bonding Around" Strategy

If you are in a rush to sell and can't find the old contractor, you can "Bond Around" the lien.

You pay the disputed amount (plus interest) to a surety company. They issue a bond that replaces the house as collateral.

Result: The lien is lifted from the house, and you can sell immediately while you fight the debt in court.

The Bottom Line: Clean Titles Close Deals

A buyer will overlook a dated kitchen. They will overlook 1970s wallpaper.

But they will never overlook a clouded title.

Doing this research costs you $0 and an afternoon of clicking.

Ignoring it could cost you the entire sale.

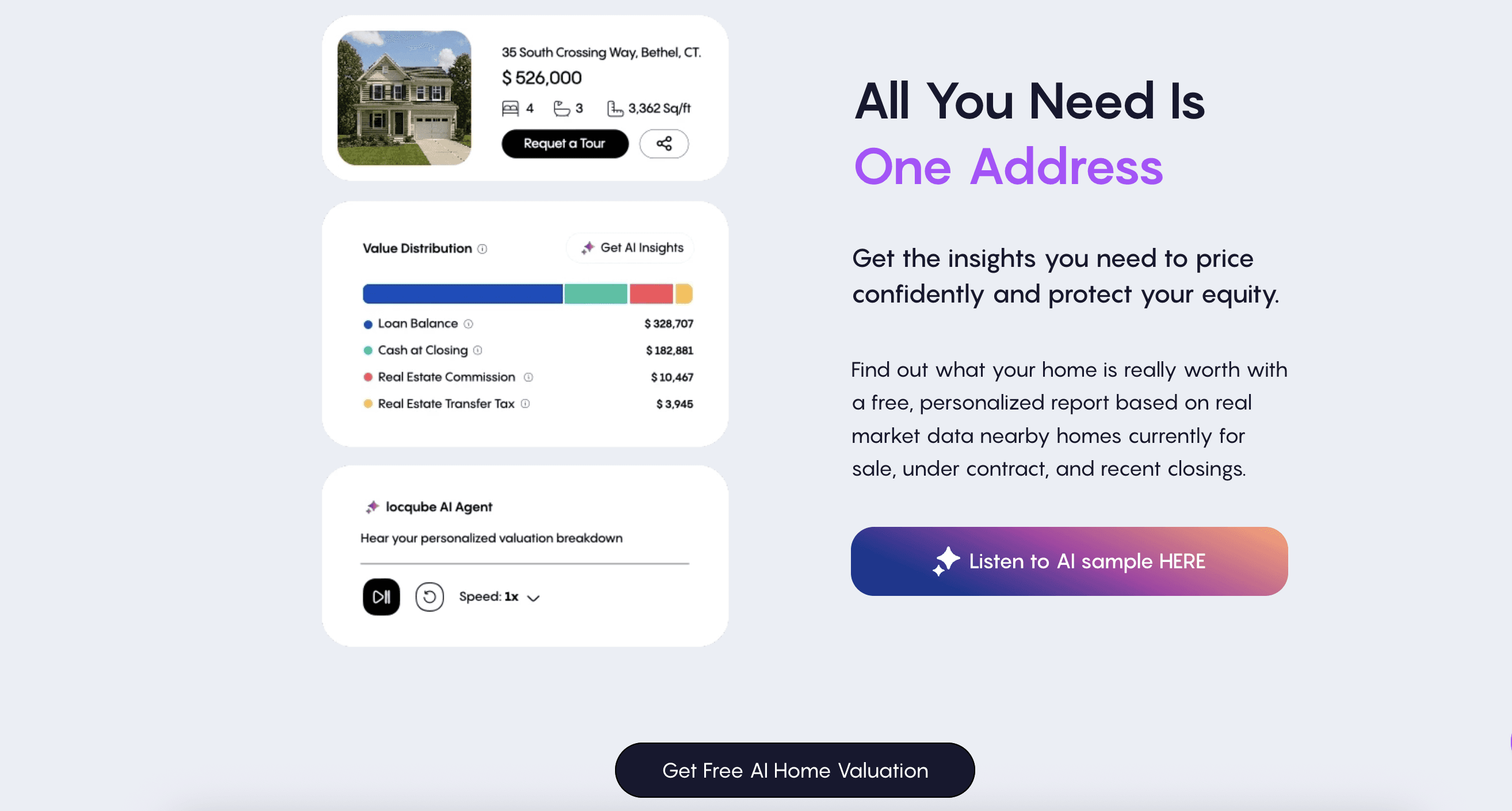

Is your home actually worth what you think it is?

Once you know your title is clean, find out what your asset is actually worth in today's market.

Get Your Free "Clean Title" Valuation Here