You see a house on Zillow listed for $500,000.

You assume the seller is walking away with $500,000.

They aren't.

In fact, after commissions, taxes, and fees, they might be walking away with $460,000. Or less.

Most sellers make a critical mistake: They fixate on the Gross Sale Price (the vanity number) and ignore the Net Proceeds (the reality number).

If you are planning to sell in 2025, you need to stop doing "mental math" and start building a Seller’s Net Sheet.

According to new data from Clever Real Estate’s 2025 Report, the average total cost to sell a home has hit roughly 10% of the sale price. That means on a $500,000 home, you could be paying $50,000 just to leave.

Here is exactly where that money goes, and how to calculate your true "Walk-Away" number before you list.

Deduction 1: The "Big Ticket" (Commissions)

This is the largest line item on your sheet.

Despite the 2024 NAR settlement changing the rules, commissions haven't disappeared. In 2025, the national average real estate commission is hovering around 5.57% (split between the listing agent and buyer's agent).

The Math: On a $500,000 sale, 5.57% is **$27,850**.

The Strategy: As we discussed in our Seller’s Negotiation Playbook, everything is negotiable. But remember: if you offer $0 to the buyer’s agent, your home might sit on the market longer.

Deduction 2: The "Government's Cut" (Transfer Taxes)

Uncle Sam wants his share.

Depending on where you live, you will pay a Transfer Tax (sometimes called "Documentary Stamps") to transfer the deed to the new owner.

The Cost: It varies wildly.

In Colorado, it's practically free (1 cent per $100).

In Pennsylvania, it can be up to 2% of the sale price.

In Washington State, it’s a tiered system that can reach 3%.

The Math: If you live in a high-tax state like PA, that’s another $10,000 gone on a $500k house.

Deduction 3: The "Title" Bill (Insurance & Liens)

You can't sell a house with a "Clouded Title."

As we covered in The "Clouded" Title Guide, you must pay to prove you own the home.

Owner’s Title Insurance: In many states, it is customary for the Seller to buy the Buyer a title insurance policy. This typically costs 0.5% to 1% of the purchase price.

The Math: Roughly $2,500 - $5,000.

Hidden Costs: This is also where those "Ghost Liens" pop up. If you have an unpaid contractor lien of $5,000, it gets deducted right here at closing.

Deduction 4: The "Sales Prep" (Repairs & Credits)

This is the "Silent Killer" of profits.

You might think your house is perfect, but the buyer’s inspector will disagree.

In 2025, sellers are paying an average of $5,277 in concessions (credits to the buyer for repairs) to keep deals alive(https://cleveroffers.com/research/cost-to-sell-a-house-2025/)].

And that doesn't include the $21,000 the average seller spends on pre-listing repairs and painting before the sign even goes in the yard.

The Final Calculation: Your DIY Net Sheet

Grab a napkin. Let’s do the real math on a hypothetical $500,000 sale.

Item | Estimated Cost | Running Total |

Sale Price | + $500,000 | $500,000 |

Mortgage Payoff | - $200,000 | $300,000 |

Commission (5.5%) | - $27,500 | $272,500 |

Transfer Tax (~1%) | - $5,000 | $267,500 |

Title/Escrow Fees | - $3,000 | $264,500 |

Repairs/Credits | - $5,000 | **$259,500** |

The Reality Check:

You "Sold" for $500k, but you "Kept" $259k.

The Bottom Line: Start with the Right Number

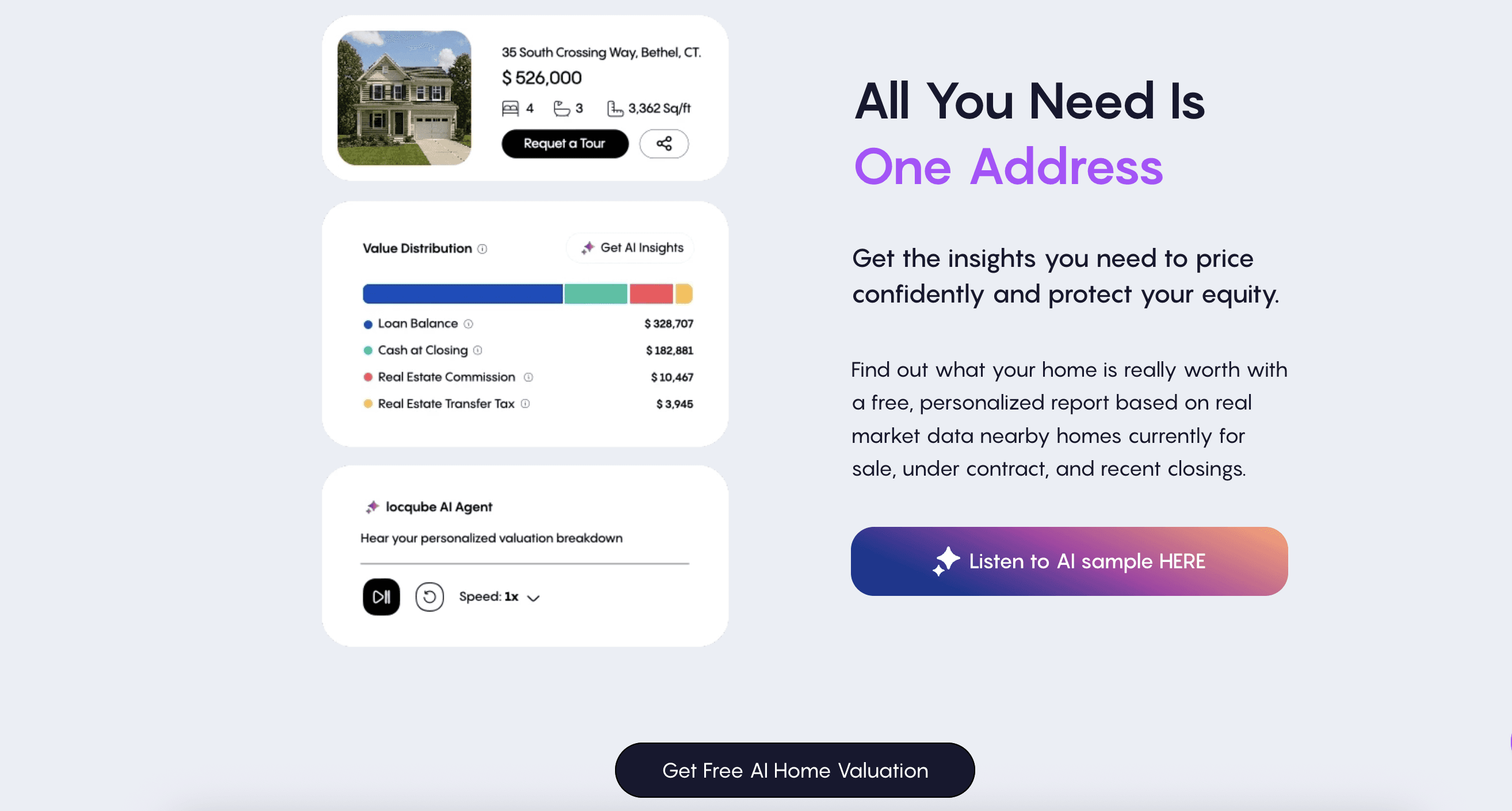

You cannot calculate your Net if your Gross is wrong.

If you assume your house is worth $500,000 but the market only supports $480,000, your entire Net Sheet is broken.

Don't guess. Start with accurate, real-time data.

Step 1: Get your verified Gross Value below.

Step 2: Apply the "10% Rule" (deduct 10% for costs).

Step 3: Plan your next move with confidence.

Get Your Verified Home Value Here