You didn't buy this house. You inherited it. And along with the memories (and maybe a garage full of old boxes), you inherited a massive financial question mark.

Do I sell it? Do I rent it? And if I sell it, will the IRS take half the money?

If you are navigating probate or a trust in 2025, you need to know about a tax rule that feels like a loophole but is actually 100% legal. It is called the Step-Up in Basis.

Most real estate blogs talk about "Buy Low, Sell High." But when you inherit a home, the goal is actually to "Reset High."

Here is how to use the Step-Up rule to potentially pay zero capital gains tax on a property that has been in your family for decades.

The Problem: The "Low Basis" Trap

To understand the solution, you have to understand the trap.

Let’s say your parents bought their home in 1980 for $50,000. Today, in 2025, that home is worth $550,000.

If your parents had sold it while they were alive, they would have had a "Capital Gain" of **$500,000** ($550k Sale Price - $50k Original Cost). Even with the standard exclusions, they might have owed a hefty tax bill.

But you aren't them. And you didn't buy it in 1980.

The Solution: The "Step-Up" Reset Button

When you inherit a property, the IRS does not look at what your parents paid for it. They look at what the house was worth on the day they died.

This is the Step-Up in Basis.

Old Cost Basis: $50,000 (1980 value)

New Stepped-Up Basis: $550,000 (2025 Date of Death value)

Why this saves you money: If you turn around and sell the house one month later for $550,000, your "Profit" in the eyes of the IRS is... $0. ($550k Sale Price - $550k New Basis = $0 Gain).

You pocket the cash. The IRS gets nothing.

According to Fidelity's 2025 Estate Planning Guide, this rule remains one of the most powerful wealth-transfer tools available, yet nearly 50% of heirs fail to document it correctly.

The Critical Step: The "Date of Death" Valuation

This tax break isn't automatic. You have to prove it.

The IRS will not just take your word that the house was worth $550,000. You need a paper trail. Specifically, you need a "Date of Death" Valuation (also called a Retrospective Appraisal).

This is different from a standard appraisal. If your relative passed away 6 months ago, you cannot use today's value. You need to know what the market was doing 6 months ago.

This is where data wins. In our previous guide on Actual Age vs. Effective Age, we talked about how upgrades change value. The same logic applies here. Did the market spike in the spring but cool off in the fall? If you value the home at the "Peak" of the market (when it was worth more), you get a higher Step-Up, which means less tax for you when you sell.

What If You Don't Sell Immediately?

Sometimes, you aren't ready to let go. Maybe you want to rent the house out for a few years.

Be careful. If you hold the property and it keeps appreciating, you will owe taxes on the new growth.

Example:

Inherited Value (2025): $550,000 (Your New Basis).

Sold Value (2028): $600,000.

Taxable Gain: $50,000.

However, as we discussed in The Seller’s Net Sheet, you can deduct costs like selling commissions and transfer taxes to lower that bill even further.

The "Double Step-Up" (Community Property States)

If you live in a "Community Property" state (like California, Texas, or Washington), you might hit the jackpot.

In these states, when one spouse dies, the entire house gets a Step-Up in Basis, not just the deceased spouse’s half. This "Double Step-Up" can save a surviving spouse hundreds of thousands of dollars if they decide to downsize.

The Bottom Line: Don't Guess the Value

Inheritance is emotional. Taxes are mathematical.

If you guess the value of the home too low, you are voluntarily signing up for a bigger tax bill later. You need precise, historical data to lock in the highest possible basis.

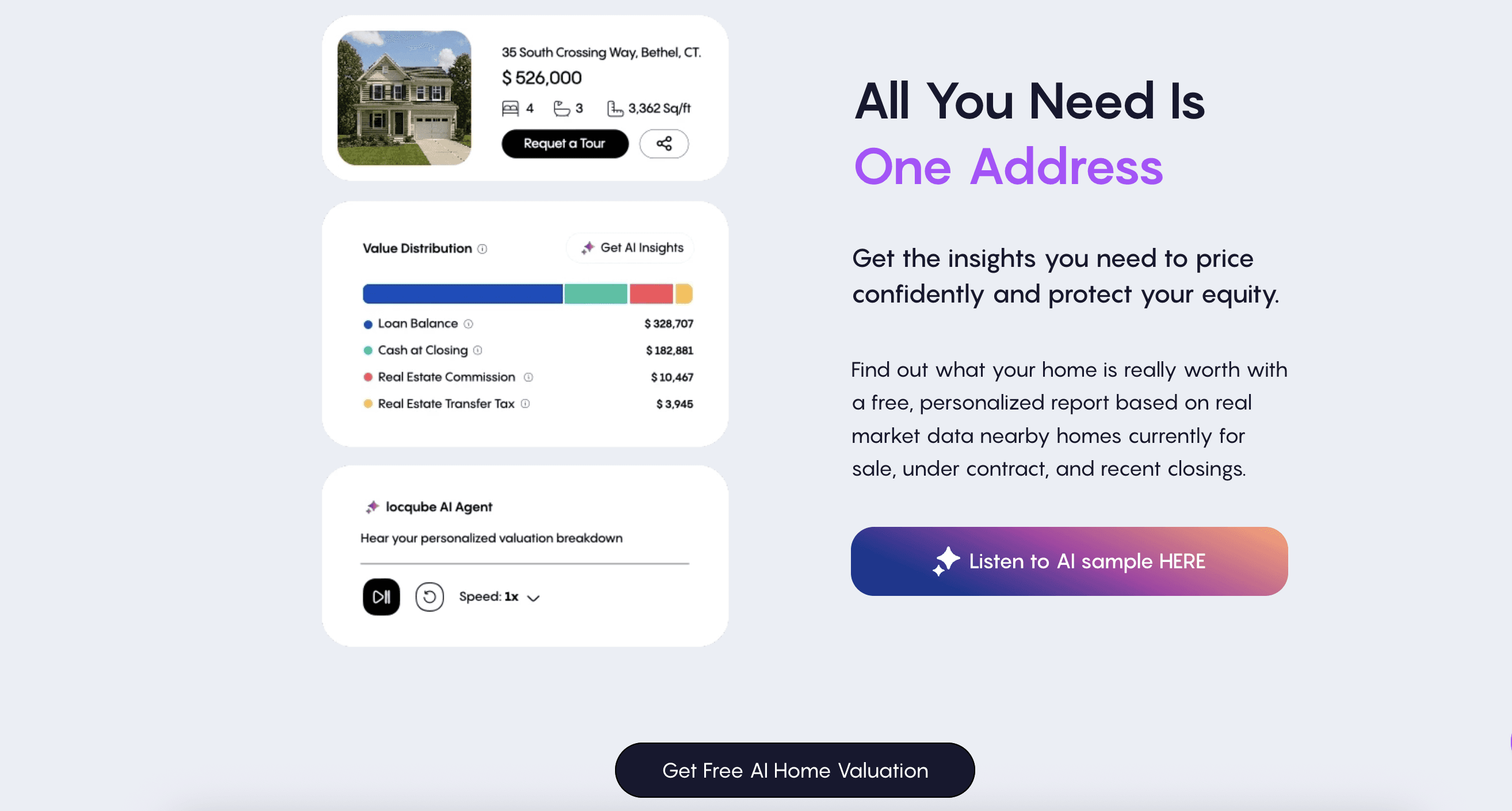

Need to know what the home was worth 3 months ago? Our valuation tool isn't just for today. Our data goes back in time to help you find the accurate market value for any specific date.

Get Your Retroactive "Date of Death" Value Here