Yes, homes usually sell for their appraised value—or higher. But if you are in a bidding war where the price has been driven up artificially high, the bank might slam on the brakes.

Here is the reality: The "Sold Price" is what a buyer is willing to pay. The "Appraised Value" is what the bank is willing to lend.

Usually, these two numbers align. But in 2025, with inventory still tight in many markets, we are seeing "Appraisal Gaps" where the agreed price is higher than the bank’s opinion.

If you are a seller holding your breath for that appraisal report, here is exactly what you need to know.

Appraised Value vs. Market Value: What’s the Difference?

Before we talk about deal-breakers, let's clarify why these numbers differ.

Market Value is emotional. It’s driven by demand. If three buyers are fighting over your home, the "Market Value" is whatever the winner offered—even if it’s $20,000 over asking.

Appraised Value is historical. It is cold, hard data based on what other homes sold for in the last 3-6 months.

The problem? In a fast-rising market, the data lags behind reality. Your house might be worth $500,000 today, but if the comps from three months ago only support $480,000, you have a problem.

The Good News: The Odds Are in Your Favor

It’s easy to panic, but let’s look at the actual data.

According to a recent report by Corporate Settlement Solutions (CSS), in the second half of last year, roughly 57% of home appraisals actually came in higher than the sales price.

Furthermore, CoreLogic data suggests that only about 8% of homes appraise below the contract price.

So, statistically speaking? You are probably safe.

But if you fall into that unlucky 8%... things get tricky.

What Happens If the Appraisal Is Low?

This is the scenario that keeps sellers up at night.

Let’s say you agreed to sell your home for $400,000, but the appraiser says it’s only worth $380,000.

The bank will only lend on the $380,000. That leaves a $20,000 hole in the deal. This is called the Appraisal Gap.

If this happens, the deal doesn't automatically die. You have four options:

1. The Buyer Pays the Difference in Cash This is the best-case scenario for you. If the buyer really wants the house (and has the cash), they can pay their down payment plus the extra $20,000 to bridge the gap.

Likelihood: High in a seller's market; low with first-time buyers who are cash-strapped.

2. You Lower the Price You agree to sell for the appraised value ($380,000). You lose $20,000 on paper, but you keep the deal alive.

Why you might do this: If you need to move quickly, or if you know the appraisal is accurate and the next buyer will face the same issue.

3. You Meet in the Middle Compromise. You drop the price to $390,000, and the buyer brings an extra $10,000 cash to closing. Everyone feels a little pain, but the house gets sold.

4. The Deal Falls Through If the buyer signed a contract with an Appraisal Contingency, they can walk away with their earnest money deposit if the numbers don't match.

Can You Challenge a Low Appraisal?

Yes, but it’s an uphill battle.

This process is called a Reconsideration of Value (ROV).

To win, you can’t just say, "My house is nicer." You need data. You (or your agent) must prove the appraiser made a factual error, such as:

They listed 2 bathrooms, but you have 2.5.

They used "comps" from a cheaper neighborhood across the highway.

They missed a major renovation, like a new roof or finished basement.

How to Protect Your Sale Price in 2025

You can’t control the appraiser, but you can influence them.

Don't let them guess. Prepare a "Home Cheat Sheet" for the appraiser. List every major upgrade you’ve done in the last 5 years, along with the cost and the date.

New HVAC (2023): $8,000

Quartz Countertops (2024): $4,500

Hand this to them when they arrive. It makes their job easier and ensures they don't miss the value-adding details.

The Bottom Line

Do homes sell for appraised value? Yes.

But in a competitive market, the "Price" is often higher than the "Value."

The best way to avoid a low appraisal is to price your home accurately from day one, using real-time data rather than guesswork.

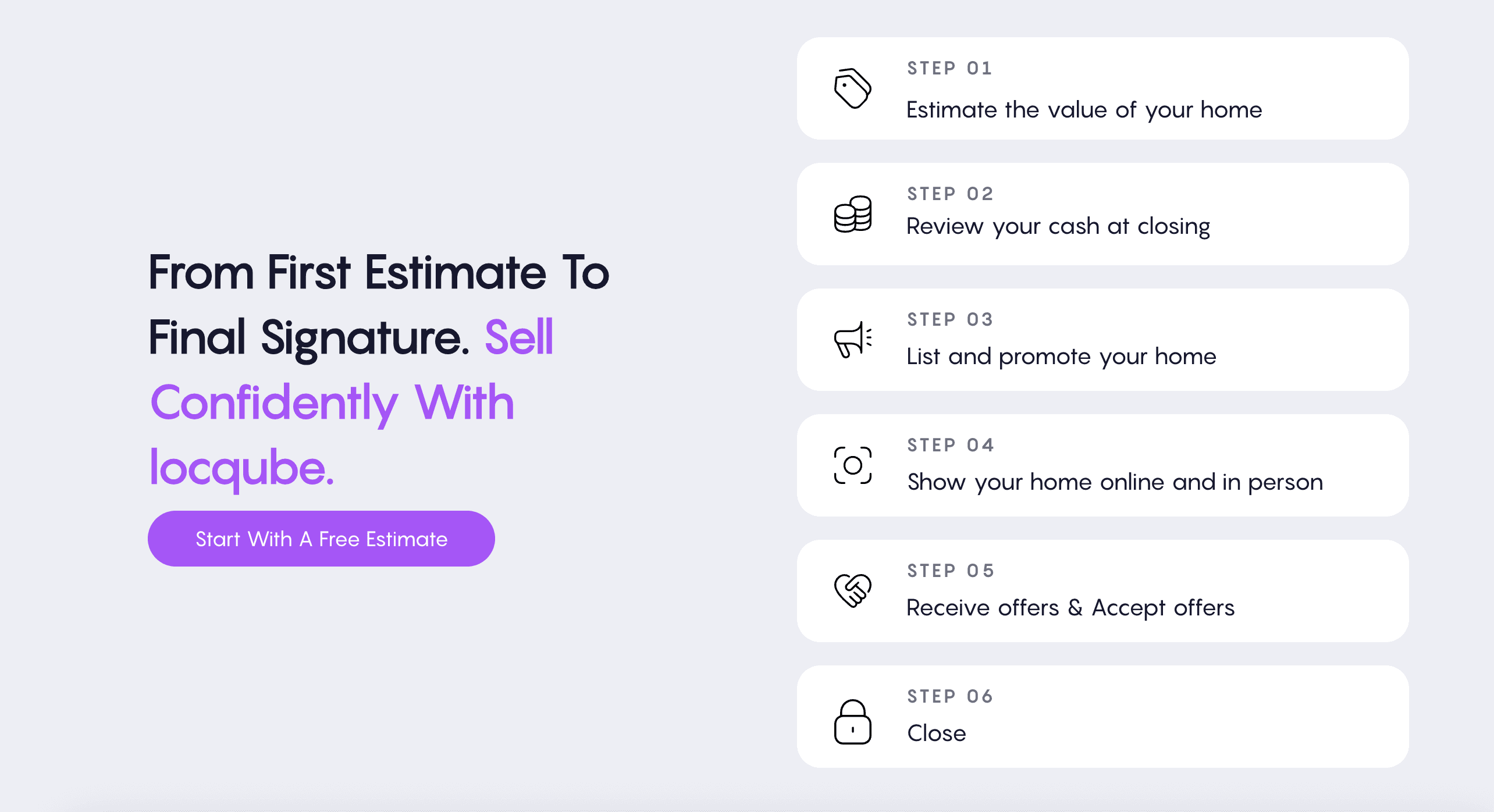

Want to know if your asking price will hold up?

Check your home’s real-time value and see recent comps in your neighborhood with our free tool.